Dubai’s villa & townhouse market in 2026 is more practical and more mature. Buyers are not chasing hype anymore. Instead, they are studying payment plans, community design, and long-term value. Investors want clear equity potential, while end users want safe and comfortable living. Because of this shift, The Valley Phase 3 vs Sobha Sanctuary comparison in Dubai is becoming increasingly important for buyers evaluating long-term value.

On one side, you have Emaar Properties, known for building large master-planned communities. On the other side, there is Sobha Realty, a developer respected for quality construction and premium finishes. Now, Sobha is expanding strongly into the townhouse segment.

So this is not only about price. It is about strategy. It is about density, payment plans, resale demand, and long-term appreciation. Therefore, if you are considering a townhouse investment in Dubai in 2026, understanding the difference between Valley Phase 3 and Sobha Sanctuary is essential.

Let’s break it down in simple terms.

The Valley Phase 3 vs Sobha Sanctuary — Dubai Villa Market Strategy 2026

The Dubai villa market in 2026 requires a completely different mindset compared to previous years. Earlier, many investors entered projects with the intention of short-term flipping. However, the rules have changed. Most developers now require 40-50% of the property value to be paid before issuing a resale NOC. As a result, quick flips are no longer easy. Capital gets locked in for longer periods. Therefore, strategy has become more important than ever.

Today, success in Dubai villa investment in 2026 depends on timing and structure. Investors must study the payment plan carefully. A 60/40 plan can create stronger early equity opportunities compared to an 80/20 structure. In addition, entering during the first launch phase often provides pricing advantages.

At the same time, end users are also thinking more practically. They are not just comparing brochure designs. Instead, they are analysing long-term comfort, space efficiency, and resale value. This shift has made comparisons like Emaar Valley Phase 3 vs Sobha Sanctuary villas more relevant than ever. Buyers want clarity. They want numbers. They want real community value.

To make a smart decision in 2026, buyers typically evaluate several core factors:

- Price per square foot: to understand true market positioning

- Plot size vs built-up size: to assess real livable space

- Density and total supply: to predict future appreciation potential

- Brand strength: to ensure resale liquidity and trust

- End-user appeal: to secure rental demand and market stability

- Equity potential at 40-50% payment stage: to evaluate exit opportunities

Because of these factors, the debate around Valley Phase 3 and Sobha Sanctuary is not emotional. It is strategic. Buyers are comparing numbers, supply, and timing rather than marketing headlines. In 2026, careful planning is what separates average investments from strong ones.

Community Scale Comparison — The Valley Phase 3 vs Sobha Sanctuary

In Dubai’s 2026 property market, community scale plays a major role in long-term appreciation. Buyers are no longer purchasing just a property. Instead, they are investing in an entire ecosystem. Roads, parks, retail zones, density planning, and future supply all influence value. Therefore, when comparing large villa communities, scale and vision become critical decision factors.

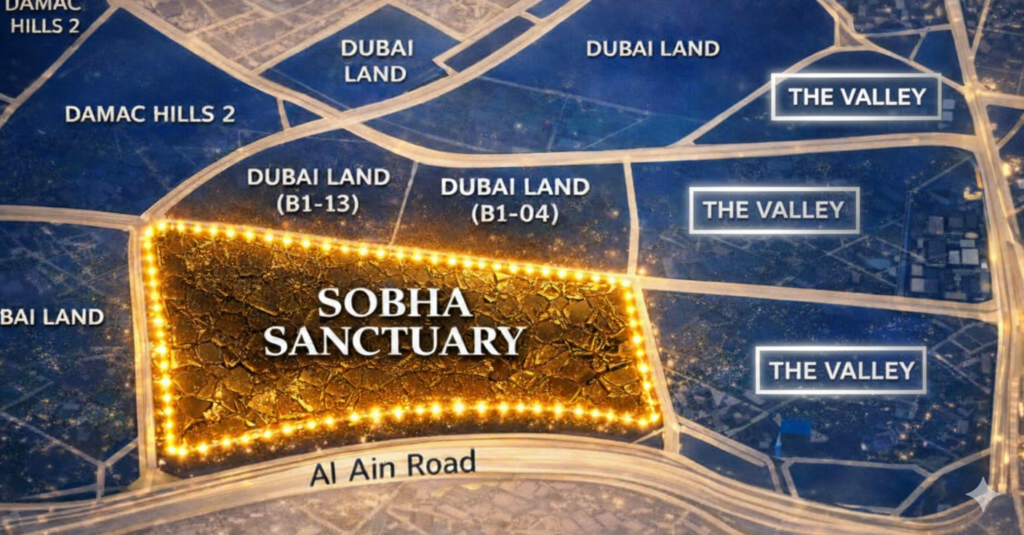

Two major names stand out in this discussion: The Valley and Sobha Sanctuary. Both operate in the growing corridor of Dubai. However, their approach to community planning is very different.

The Valley Phase 3: Evolution of a Master Community

The Valley was launched in 2019, during a period when affordability was the key focus. At that time, Dubai’s villa market was adjusting to post-pandemic conditions. Buyers wanted space, but at accessible price points. Valley answered that demand.

Now, Phase 3 reflects a shift in positioning. The planning feels more refined. Density is better distributed. And the vision is becoming more premium compared to earlier launches.

The total Valley master development is expected to span:

- 60 – 70 million sq ft

- 8,500 – 10,000 villas across multiple phases

This makes it one of the larger villa townships in Dubai’s emerging corridor.

Although the scale is significant, the advantage is visibility. Earlier clusters are already operational. Residents have moved in. Parks are functioning. Internal roads are active. Infrastructure is built.

For end users in the Dubai villa market, this visibility builds trust. When buyers see completed homes and active communities, confidence increases. Rental demand also becomes easier to project.

However, there is another side to scale. A larger supply can moderate rapid price spikes. Appreciation tends to be structured and gradual rather than explosive. Therefore, Valley’s strength lies in stability and liquidity.

Sobha Sanctuary | Controlled Supply with Premium Positioning

Sobha Sanctuary takes a different approach. The total land parcel is approximately 38 million sq ft, which is smaller compared to the Valley. More importantly, the total villa and townhouse supply is estimated at around 2,200 units.

This creates a lower-density environment.

Sobha has traditionally focused on premium villas and high-end developments. While the brand is well known for quality construction, this is one of its first large-scale integrated villa communities in this specific belt.

The reduced density creates scarcity. Scarcity often supports stronger capital appreciation, especially during early launch phases. When supply is controlled, price revisions can be sharper if demand remains steady.

In Dubai’s 2026 villa market, lower density appeals to buyers looking for exclusivity and privacy. It also supports long-term resale positioning.

However, Sobha Sanctuary is still in its development phase. Unlike Valley, it does not yet have visible residential movement. Infrastructure is progressing, but the community lifestyle is not fully experienced on the ground.

Therefore, the comparison becomes clear:

- Valley offers maturity and visible ecosystem strength.

- Sobha Sanctuary offers scarcity and premium positioning.

Both models can work in the Dubai villa market. The difference lies in whether a buyer prioritises stability or early-phase appreciation potential.

Location Analysis: The Emirates Road Belt Advantage in 2026

Location is no longer just about distance to Downtown. In 2026, smart investors look at growth corridors. They study infrastructure plans, highway connectivity, and long-term urban expansion. As a result, the belt connecting Emirates Road and Al Ain Road has become one of the most-watched villa zones in Dubai.

Both The Valley and Sobha Sanctuary are within this expanding corridor. This positioning is not accidental. It reflects a clear strategy by developers to be in the affordable luxury villa segment while maintaining access to central Dubai.

Connectivity Comparison — The Valley Phase 3 vs Sobha Sanctuary

The corridor offers several key benefits:

- Direct connectivity to Academic City

- Easy access to Dubai Silicon Oasis

- Smooth entry to Emirates Road and Al Ain Road

- Reduced congestion compared to inner-city communities

However, timing matters.

Valley entered this corridor earlier. As a result, it enjoys a first-mover advantage. Early buyers benefited from lower launch pricing. More importantly, the community has already contributed to validating the area as a residential destination.

On the other hand, Sobha Sanctuary is launching at a different stage of the cycle. The corridor is now proven. Buyer confidence is stronger. Risk perception is lower. Therefore, Sobha benefits from entering an already validated growth zone rather than pioneering it.

Built-Up Area vs Plot Size: The Hidden Deciding Factor

Many buyers focus on built-up size. However, in townhouse living, plot size determines long-term comfort.

The built-up difference between Valley Phase 3 and Sobha Sanctuary is marginal, approximately 5%. However, the plot size difference is more noticeable.

Space Comparison — The Valley Phase 3 vs Sobha Sanctuary

| Project | Approx. Built-Up | Approx. Plot Size |

| Valley Phase 3 | ~2,100–2,200 sq ft | ~1,600 sq ft |

| Sobha Sanctuary | ~2,200+ sq ft | ~1,800–1,900 sq ft |

The additional 200–300 sq ft of land in Sobha Sanctuary improves outdoor usability. It enhances privacy and long-term comfort. For families prioritising space, this is meaningful. For pure investors, it strengthens resale appeal.

Price & Price Per Square Foot Comparison 2026

Price remains one of the strongest decision drivers in the Dubai villa market 2026. However, smart buyers are no longer looking at total price alone. Instead, they analyse price per square foot, entry ticket size, and long-term positioning. Therefore, comparing numbers between projects gives better clarity than marketing brochures.

When we examine The Valley Phase 3 and Sobha Sanctuary, the pricing gap becomes visible immediately.

2026 Price Snapshot

| Factor | Valley Phase 3 | Sobha Sanctuary |

| Starting Price | ~AED 3.5 – 3.6M | ~AED 4M |

| Price per Sq Ft | ~AED 1,450 | ~AED 1,600 |

| Premium Difference | — | ~9% higher |

Sobha carries roughly a 9% premium in price per square foot. In addition, the entry ticket is approximately 14% higher compared to the Valley. The natural question is: Is this premium justified?

From a structural standpoint, Sobha’s pricing strategy is supported by several positioning factors:

- Lower overall community density

- Larger average plot sizes

- Strong brand perception for construction quality

Lower density often creates scarcity value. Larger plots improve end-user appeal. Meanwhile, brand perception can influence resale confidence.

However, Valley offers its own strategic advantages:

- Lower entry price, which reduces capital exposure

- Established community movement and visible infrastructure

- Historically strong resale liquidity due to brand recognition

Therefore, the price difference is not simply about branding. It reflects two different investment strategies.

Sobha positions itself as a lower-density, premium villa play with potential demand-driven appreciation. Valley positions itself as a structured, supply-driven master community with steady growth and liquidity strength.

In Dubai’s 2026 villa market, buyers are not just asking which is cheaper. Instead, they are asking which pricing model aligns with their capital strategy and risk.

Payment Plan & Equity Potential

In 2026, payment plans are no longer just a convenience; they shape investor decisions. Developers use structured plans to balance liquidity, demand, and risk. For villa buyers, the payment plan often determines how quickly equity can be realised and how much capital is exposed upfront.

| Project | Payment Plan | Investor Advantage |

| Valley Phase 3 | 80/20 | Strong brand liquidity, stable resale potential |

| Sobha Sanctuary | 60/40 | Better early equity play, lower upfront commitment |

The Valley typically follows an 80/20 payment structure. This means 80% of the villa price is paid before handover, leaving only 20% post-completion. While this ensures brand credibility and resale liquidity, it also requires higher upfront capital.

On the other hand, Sobha Sanctuary adopts a 60/40 structure. Here, only 60% is required upfront, with the remainder paid closer to handover. This lower initial commitment allows investors to target early equity gains without locking in as much capital.

The choice depends on the buyer’s strategy:

- Investors targeting exit at 40–50% payment: Sobha Sanctuary offers higher early equity potential.

- Long-term holders focused on brand stability and resale confidence: Valley Phase 3 provides a safer, more predictable path.

Understanding your financing options can be just as important as comparing communities — check how mortgage services in Dubai can help structure your villa purchase.

Investor vs End User Perspective in Dubai’s 2026 Villa Market

In the 2026 Dubai villa market, the right choice depends heavily on buyer intent. Villas are no longer bought solely based on price or design. Instead, investors and end users have distinct priorities that influence which community they prefer.

Families evaluating long-term living can browse ready to buy homes in Dubai to compare completed communities.

For Investors

Investors are primarily focused on early entry and equity growth. They study supply numbers, phase launches, and payment structures carefully. From this perspective, Sobha Sanctuary offers several advantages:

- Lower overall supply, creating scarcity

- Early phase entry, allowing access to initial pricing benefits

- Flexible 60/40 payment structure, reducing upfront capital exposure

- Larger plot sizes relative to build-up, enhancing asset value

These factors combine to provide investors with stronger equity growth potential, especially if they plan to exit or flip within the first few years of development. Sobha Sanctuary’s limited density and premium positioning can accelerate appreciation in the early phases, making it an attractive investment play.

For End Users

End users, on the other hand, prioritise community experience and long-term comfort. Buyers in this segment want visible development, functioning infrastructure, and a safe environment for families. This is where The Valley shines. Key advantages include:

- Active residents and established clusters

- Well-maintained parks and functioning internal roads

- A tangible community feel, giving emotional and practical security

- Proven township planning and long-term infrastructure reliability

For end users, Valley Phase 3 is not just a villa purchase; it is a lifestyle choice. The visibility of residents and completed infrastructure reduces risk, making it a secure long-term living option.

So, which is the Better Villa Community to invest in in 2026?

In Dubai’s 2026 villa market, the “better” community depends entirely on your goals. Buyers need to look beyond marketing and focus on payment plans, plot size, density, and community value.

If your aim is early equity release and lower upfront capital, Sobha Sanctuary is attractive. Its lower density, premium positioning, and 60/40 payment plan create opportunities for demand-driven appreciation. Early-phase investors may capture higher returns with smart timing.

If you value established community living, brand reliability, and slightly lower entry prices, Valley Phase 3 by Emaar is a safer choice. The community already has active residents, visible infrastructure, and proven planning, offering strong resale liquidity and long-term confidence.

Dubai’s 2026 villa market rewards a clear strategy. Know your objective, and your investment decision becomes far easier and more profitable.

For personalised insights into your villa strategy, get in touch with our Dubai real estate consultation service to tailor a plan based on your goals.